Wells Fargo REO Property Donation Program free printable template

Show details

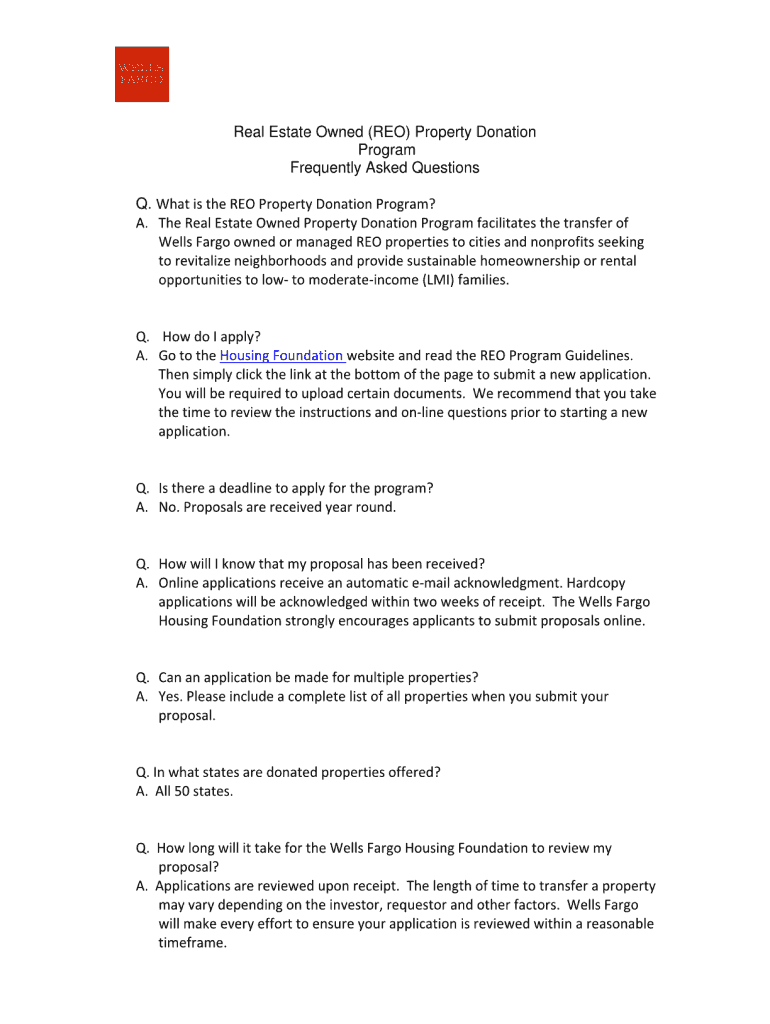

Real Estate Owned (RED) Property Donation Program Frequently Asked Questions Q. What is the RED Property Donation Program? A. The Real Estate Owned Property Donation Program facilitates the transfer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donating property to a nonprofit allen park form

Edit your nonprofit organizations that wish to that utilize the donated properties form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the wells fargo reo property donation program is an initiative for various community benefit purposes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit real estate donation allen park online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donate land to charity allen park form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donate real estate allen park form

How to fill out Wells Fargo REO Property Donation Program

01

Visit the Wells Fargo REO Property Donation Program webpage.

02

Review the eligibility criteria for property donations.

03

Complete the application form provided on the site.

04

Provide details about the property, including location, condition, and any applicable liens.

05

Submit required documentation, such as proof of ownership and property tax statements.

06

Wait for confirmation from Wells Fargo regarding your application status.

07

If approved, follow any additional instructions provided by Wells Fargo for the donation.

Who needs Wells Fargo REO Property Donation Program?

01

Nonprofit organizations looking for properties to support their community initiatives.

02

Individuals or businesses seeking to donate a property for charitable purposes.

03

Organizations focused on affordable housing and homelessness prevention efforts.

Fill

donating property to a nonprofit romulus

: Try Risk Free

People Also Ask about donating property to a nonprofit lyon charter township

Are donated assets recorded at fair value?

Donated financial assets are also initially recognized when received and are measured at their fair value and subsequently carried at their fair value.

What is the accounting entry for a donated asset?

In the for-profit world, a company receiving a donated asset will record the donation as a debit to "Fixed Asset" and a credit to "Contribution Revenue." This records the asset on the company's books and also records revenue from receiving the donation.

How do you record donated land?

Like any transaction, recording a donated asset requires making two entries. For a generalized donated asset transaction, use the following entries: Debit an asset account (cash, inventory, buildings, land, etc.) Credit "contribution revenue" (for a for-profit company) or "contributions" (for a nonprofit company).

How do you record a donated asset for a non profit?

Non-For-Profit Accounting: Journal Entries If the asset passes as such and is substantial, then debit "Expense" and credit "Unrestricted Contributions." If someone donates a substantial amount but the asset is not passed to another person, then record the donation by debiting "Assets" and crediting "Contributions."

What is the difference between a donation and a contribution?

The difference between donations and contributions is that donations are quantifiable gifts, such as money, given to a charity, and contributions are gifts that may or not be quantifiable, such as funds or even your time or talents, provided for a cause you want to support.

What is the journal entry for donated assets?

For-Profit Accounting Journal Entry In the for-profit world, a company receiving a donated asset will record the donation as a debit to "Fixed Asset" and a credit to "Contribution Revenue." This records the asset on the company's books and also records revenue from receiving the donation.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my donating property to a nonprofit wyandotte in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your donating real estate to charity allen park and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find donating property to a nonprofit lincoln park?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific what is wells fargo reo for various community benefit purposes and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in donating property to a nonprofit chesterfield?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your donate house to charity allen park and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is Wells Fargo REO Property Donation Program?

The Wells Fargo REO Property Donation Program is an initiative that allows Wells Fargo to donate real estate owned (REO) properties to eligible nonprofit organizations for various community benefit purposes.

Who is required to file Wells Fargo REO Property Donation Program?

Nonprofit organizations that wish to receive a property donation through the Wells Fargo REO Property Donation Program must file an application or request as part of the eligibility process.

How to fill out Wells Fargo REO Property Donation Program?

To fill out the Wells Fargo REO Property Donation Program application, nonprofits must provide detailed information about their organization, the intended use of the property, and other relevant documentation as specified in the program guidelines.

What is the purpose of Wells Fargo REO Property Donation Program?

The purpose of the Wells Fargo REO Property Donation Program is to contribute to community revitalization and support nonprofit organizations in addressing housing needs and other community initiatives.

What information must be reported on Wells Fargo REO Property Donation Program?

Organizations participating in the Wells Fargo REO Property Donation Program must report information regarding property usage, compliance with terms of donation, and progress on community projects that utilize the donated properties.

Fill out your Wells Fargo REO Property Donation Program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Banks That Donate Property To Nonprofit Organizations is not the form you're looking for?Search for another form here.

Keywords relevant to donating property to a nonprofit genoa

Related to donate real estate lincoln park

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.